I have sold two items since my last update and bought three items. I sold the Full Sheet White Set and made $11.23 of profit. This type of brand in white normally sells very quickly. However, there are times when certain sizes don’t sell for an appropriate amount to make it a good flip for me. If I find the full size again I will buy multiple sets of them again if they are available. I was not able to list these until after the holiday and it sold it less than a week.

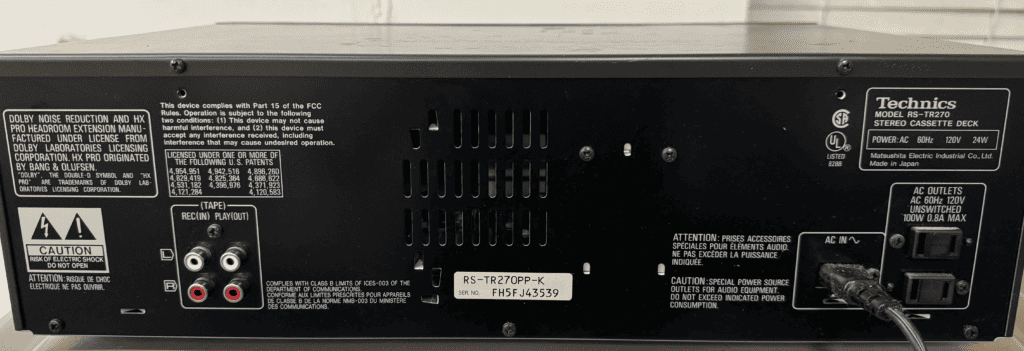

I also sold the Technics Tape player on craigslist and made $17.71 of profit on the same day I sold the Full White Sheet Set. I had an interesting conversation with the person I sold the tape player too. He wanted to make sure and meet in a crowded area to be able to test the item. He told me he got robbed one time when he met someone to buy something off of craigslist, and always meets in a crowded area now. I have always met people in an area with lots of other people when selling craigslist items, before this interaction. This seemed like a good idea to me from a safety perspective. Making sure I am not putting myself at risk when doing flips is something I’ve always considered a first level thing compared to the profit I’m hoping to make.

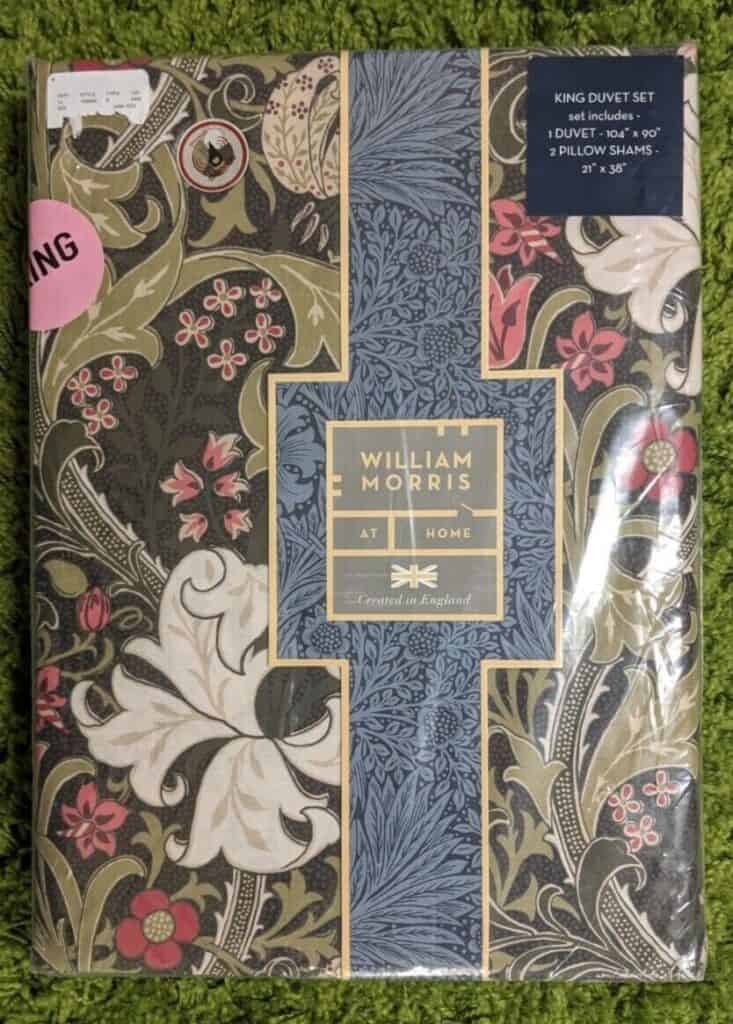

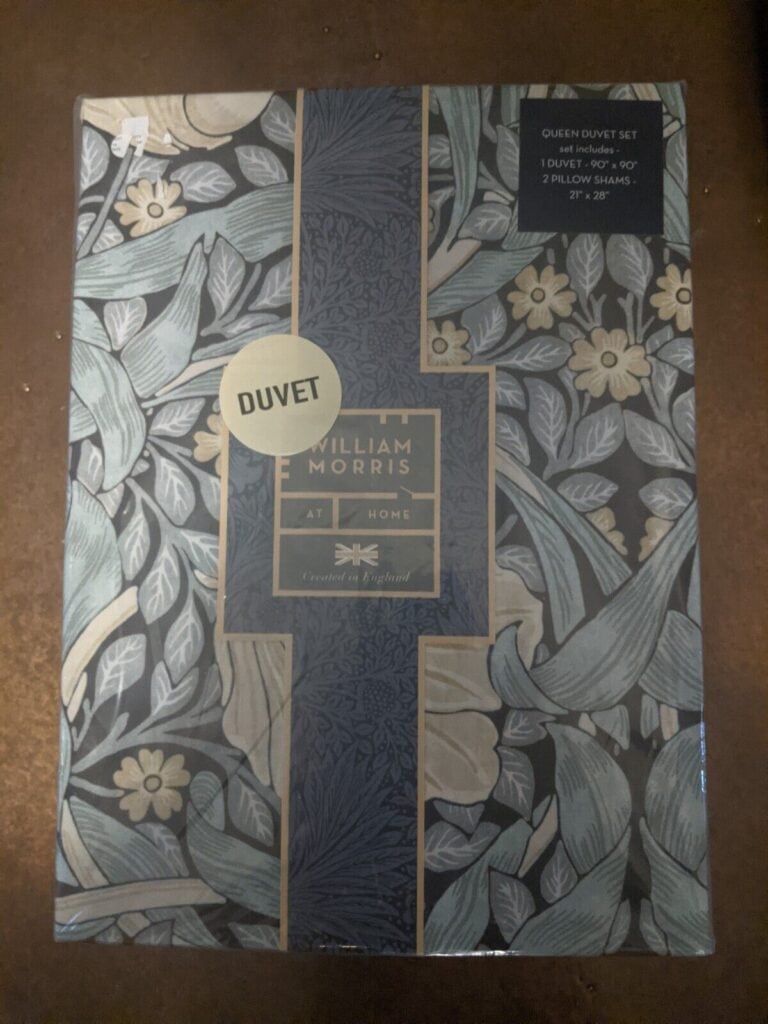

I bought a new set of William Morris Queen Sheet Sets and a Peter Reed Reina Blue King Duvet. A week later after the two sales I had I went back and bought another Peter Reed Reina Blue King Duvet. I bought well on both of these and will hopefully make at least 50% on my money on these items. I’m much higher on this right now, because if I need to lower the sales amount I can still meet my goal for margin on these larger items. I am hoping to run up the amount by $1000 of profit this year, but I don’t control how sales will go. As long as I buy at a good price then I have set myself up to potentially be successful.

I have $47.84 more to invest to get back to fully invested again, and am at $760.42.

Current Inventory

| Item | Cost | Date Purchased | Sold | Profit |

| NFL Puzzle | $3.45 | 6/27/22 | ||

| Serving Dish and Bowl | $9.29 | 7/20/22 | ||

| *2 Coca Cola Puzzles | $6.91 | 9/13/22 | ||

| *Floral Plate | $2.71 | 9/26/22 | ||

| *Old Spice Cologne bottle | $3.25 | 9/26/22 | ||

| *Wood block set- kid’s toy | $2.17 | 9/26/22 | ||

| *Japanese Stein 1 | $4.33 | 9/26/22 | ||

| *Satellite Puzzle | $2.37 | 11/28/22 | ||

| *Board Game | $3.78 | 1/4/23 | ||

| *Painter’s puzzle | $3.78 | 1/30/23 | ||

| *Antique? vase | $8.11 | 2/21/23 | ||

| *Antique Plates | $7.56 | 3/19/23 | ||

| *Rollerblades | $16.77 | 4/1/23 | ||

| *Granite Cutting Blades (5) | $40.54 | 4/4/23 | ||

| *Crystal bowl | $5.94 | 4/10/23 | ||

| *Perfume bottle | $8.11 | 4/10/23 | ||

| *Casserole dish | $8.11 | 5/17/23 | ||

| *Nike Air Jordan V.5 Canvas | $27.11 | 5/22/23 | ||

| * Air Jordan Flight Remix Wolf Grey | $42.50 | 5/24/23 | ||

| *Coffee Cup- Floral | $2.70 | 6/20/23 | ||

| *Twin Duvet Set | $25.98 | 6/21/23 | ||

| *Skateboard | $8.11 | 7/26/23 | ||

| *Queen Sheet Set Brown and White Plaid | $64.94 | 8/23/23 | ||

| *Technics Tape Player | $22.29 | 8/23/23 | 1/7/24 | $17.71 |

| *Accounting Book | $6.27 | 9/6/23 | ||

| *Brooks Brothers Sheet Set | $12.99 | 9/8/23 | ||

| *1.019 Share – Verizon | $33.07 | 9/29/23 | $5.35 | |

| *William Morris King Duvet | $64.94 | 11/16/23 | ||

| *Full Sheet Set White | $38.97 | 12/13/23 | 1/7/24 | $11.23 |

| *William Morris Queen Duvet | $54.11 | 12/13/23 | ||

| *William Morris Queen Duvet | $54.11 | 12/13/23 | ||

| *William Morris Queen Sheet Set | $42.22 | 1/3/24 | ||

| *Peter Reed Reina Blue King Duvet | $42.22 | 1/3/24 | ||

| *Peter Reed Reina Blue King Duvet | $42.22 | 1/10/24 | ||

| Underinvested | $47.84 | |||

| Total inventory amount | $760.42 |