I had a lot of things go on since my last update earlier in the month. I sold four items, bought one item, threw away/donated back four old items, and bought one share of stock. I have turned my $36.86 into $579.45 at this point, and need to reinvest $63.39.

Sales

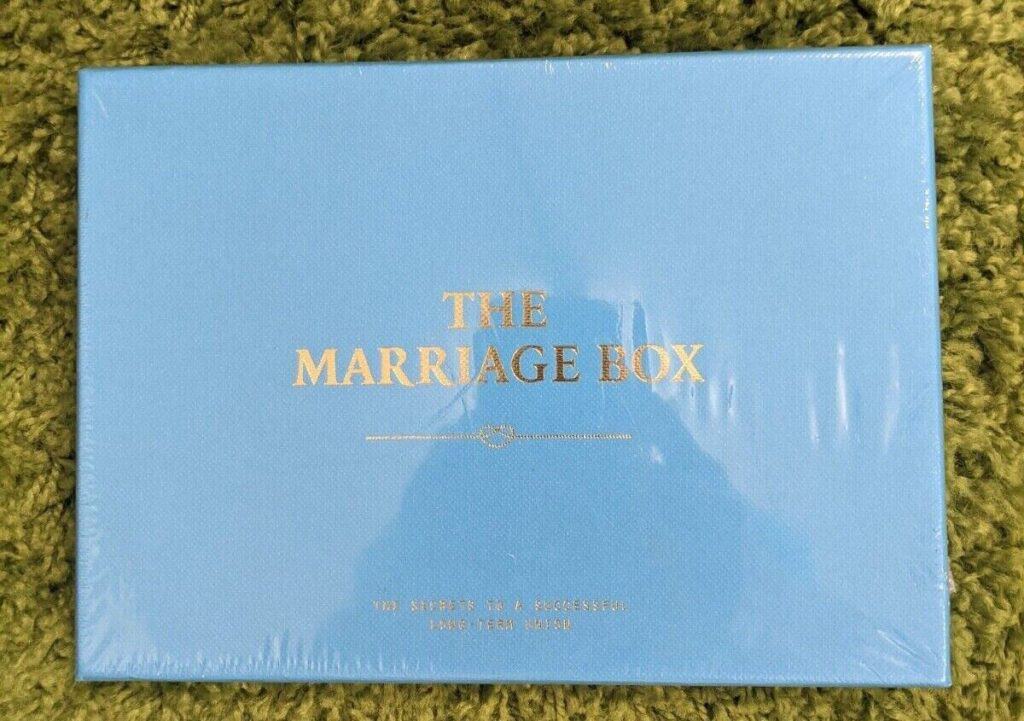

First off, I sold the following four items: One of the Accounting Books, one of the Queen Sheet Set Brown and White Plaid, the Marriage book/game, and the Teapot.

The Accounting book sold very quickly on September 17th for $21 and made $3.96 of profit in eleven days. I sold this book on Amazon which is where I bought it, and I could have sold it for maybe $25 if I wanted to wait longer. However, the quick flip is the best in my mind with the lower priced items so I can keep the money flipping over and over again.

The second item the Queen Sheet Set Brown and White Plaid sold for $117.49 on September 17th also. This is a big winner for me at $38.86 of profit after shipping it out. The one I have left is getting plenty of views which is the data I need to know it will sell also.

The third item I sold was the Marriage box/game. I had discounted it to move to help reduce the number of items in my inventory. I ended up losing $2.79 on this item after discounting it. After the lost I had $5.32 left of the original $8.11 I used to buy this item. I will talk more about this with the items I decided to throw away.

The fourth item sold was the Teapot on September 29th. The teapot was of Shakespeare’s home he was born in. It sold for $19.99 plus shipping and I ended up making $11.67 of profit off of it in six months. I tripled my money of this item. This is a great flip again. I just keep on having very good results when most items sell overall.

Purchase

I bought another William Morris duvet on Sept 29th to add to my inventory for $54.11. I should be able to make over $30 on this item. I stopped myself from buying another William Morris item which would have made me around $15. I want to try and maintain as high a profit amount as I can when I’m spending this amount on an item. I have to remember to focus on trying to make as much on items so I can grow in the best possible manner with the amount of funds I have available.

Stock buy

This is out of line with what I’ve done so far, but I felt like this a good opportunity to buy something that makes sense. I bought one share of Verizon stock at $32.40. When I buy stocks I evaluate them on the basis of the value proposition they are selling at versus what I believe they are instrinically worth, with the thought I do not know how long it would take for the market to realize they have undervalued the business overall.

The first metric I look at is price/book value. I calculate the book value of Verizon at $21.95 a share at this time. You can learn more about how to do this type of calculation by reading the Intelligent Investory by Benjamin Graham. This put the P/B value at 1.50 which is historically very low compared to where this business has been and other similar companies it competes against. The historical average of P/B has been 5.35. The trend has been going down every year for the past eight years, but even at a multiple of 4 this gives me a safety factor on a business with a very large moat.

Next, the earnings are $5 per share before getting in to see if there are any items that need to be adjusted or using a diluted amount for this. This calculates to a P/E $32.40/$5.00=6.48. The average annual earnings is $4.62 for the last five years, which gives a P/E of 32.4/4.62=7.01. The P/E average over the last eight years has been 11.73. This metric gives me confidence in the ability of Verizon to go up to a level which would normalize in the range it should trade at.

The gross margin and profit margin have maintained steady over the past eight years. The gross margin is around 57-60%, and the profit margin is around 10-15% a year. They have been able to maintain these margins even while finishing out the build out of 5G. They have added a lot of debt but are earning over $20B a year which will allow them to reduce their debt load over the years and still be able to maintain their profitability and dividend.

Verizon also can be argued to be the strongest brand in cell phone providers in the US, which is part of their moat. Five years from now they will still be making lots of money. They pay a dividend of $2.66 a share so I will earn over 8% a year while I wait for the price to come back to what I think is reasonable.

Throwing away items

I decided to throw away/donate back four items which I bought over a year ago. I ended up donating the 3 hole punch, Staple and Staple remover, and the Star Wars Puzzles. These items were all over a year old and we’re getting no views consistently for months. With where I am in buying more expensive items I’m going to throw low priced items away/donate them back to Goodwill. I say throw away because that’s the equivalent of what I’m doing on these items by giving them back to Goodwill. They main reason I’m doing this is I don’t want the items I have to take up too much space at my house. As I continue down this road I would end up having a larger percentage of cheaper items I’ve had for longer periods. This would be fine if I didn’t care about the amount of space I was using but I don’t want that to end up being an unlimited amount of space in case I ever move into a storage unit. I will throw away/donate some more items over time like I did with these as I go along. I lost $5.27 by doing this, but this represents less than one percent of the value of inventory I have currently.

Current Inventory

| Item | Cost | Date Purchased | Sold | Profit |

| NFL Puzzle | $3.45 | 6/27/22 | ||

| 3 Hole Punch | $1.18 | 6/29/22 | 9/26/23 | -1.18 |

| Serving Dish and Bowl | $9.29 | 7/20/22 | ||

| *Star Wars Puzzle | $2.37 | 7/25/22 | 9/26/23 | -2.37 |

| Star Wars Puzzle | $1.18 | 8/31/22 | 9/26/23 | -1.18 |

| *2 Coca Cola Puzzles | $6.91 | 9/13/22 | ||

| *Stapler and Stapler remover | $.54 | 9/26/22 | 9/26/23 | -.54 |

| *Floral Plate | $2.71 | 9/26/22 | ||

| *Old Spice Cologne bottle | $3.25 | 9/26/22 | ||

| *Wood block set- kid’s toy | $2.17 | 9/26/22 | ||

| *Japanese Stein 1 | $4.33 | 9/26/22 | ||

| *Satellite Puzzle | $2.37 | 11/28/22 | ||

| *Board Game | $3.78 | 1/4/23 | ||

| *Painter’s puzzle | $3.78 | 1/30/23 | ||

| *Antique? vase | $8.11 | 2/21/23 | ||

| *Teapot | $5.94 | 3/3/23 | 9/29/23 | $11.67 |

| *Antique Plates | $7.56 | 3/19/23 | ||

| *Marriage book/game | $8.11 | 3/24/23 | 9/21/23 | -$2.79 |

| *Rollerblades | $16.77 | 4/1/23 | ||

| *Granite Cutting Blades (5) | $40.54 | 4/4/23 | ||

| *Crystal bowl | $5.94 | 4/10/23 | ||

| *Perfume bottle | $8.11 | 4/10/23 | ||

| *Pair of Shoes | $37.86 | 5/4/23 | ||

| *Casserole dish | $8.11 | 5/17/23 | ||

| *Nike Air Jordan V.5 Canvas | $27.11 | 5/22/23 | ||

| * Air Jordan Flight Remix Wolf Grey | $42.50 | 5/24/23 | ||

| *Rae Dunn King Sheet Set | $21.61 | 6/14/23 | ||

| *Dyson Vacuum | $20.02 | 6/20/23 | ||

| *Coffee Cup- Floral | $2.70 | 6/20/23 | ||

| *Twin Duvet Set | $25.98 | 6/21/23 | ||

| *Skateboard | $8.11 | 7/26/23 | ||

| *Queen Sheet Set Brown and White Plaid | $64.94 | 8/23/23 | 9/17/23 | $38.86 |

| *Queen Sheet Set Brown and White Plaid | $64.94 | 8/23/23 | ||

| *Technics Tape Player | $22.29 | 8/23/23 | ||

| *Accounting Book | $5.54 | 9/6/23 | 9/17/23 | $3.96 |

| *Accounting Book | $6.27 | 9/6/23 | ||

| *Brooks Brothers Sheet Set | $12.99 | 9/8/23 | ||

| *William Morris Queen Duvet | $54.11 | 9/29/23 | ||

| *1 Share – Verizon | $32.40 | 9/29/23 | ||

| Underinvested | $63.39 | |||

| Total inventory amount | $579.45 |