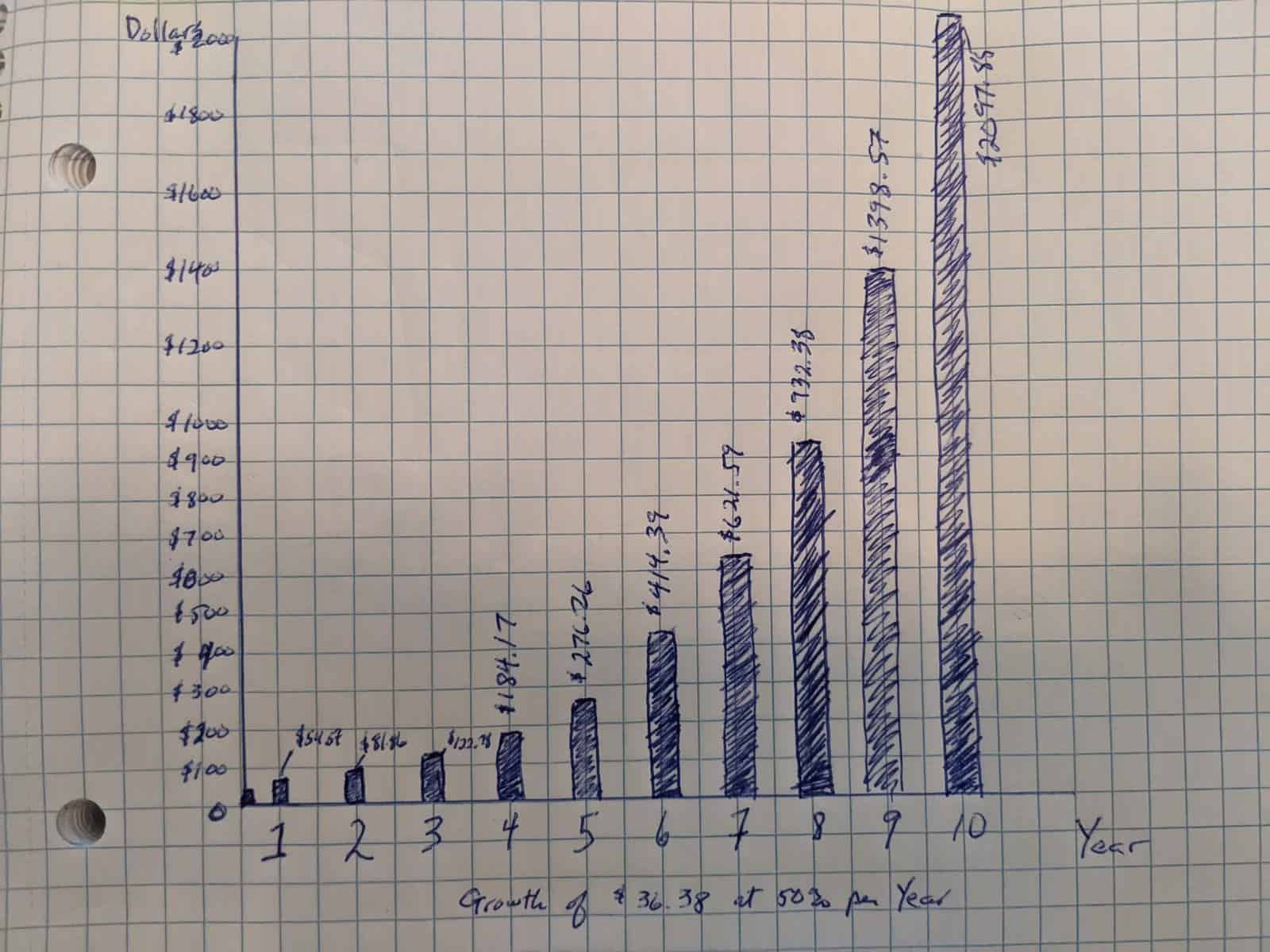

The long term is important to think about in flipping, just like it is in life overall. If you keep the long term in mind, it will help you to view each small item you buy at the beginning of an investing adventure like what I’m doing with the money from my change just to build into something which could be sizable one day. An interesting thought experiment is to think about the average life span of someone in the world at this time in the United States which currently sets at over 77 years. If someone took the $36.38, I’ve started with at age 10 and started flipping it they could have a very large sum of money if they continued to reinvest.

It would be reasonable to assume they could make at least 50 percent annually their initial investment for ten years with little difficulty. After ten years they would have $2097 and would be 20 years old. They could put this into a Roth IRA and invest it in an index fund and when they were 60, if it returned 10% annual return, they would have over $94,000 from a start of $36.38. That is the power of the long term put to use.

Modify the scenario and build up to your $2097 and then decide to aim for a 50 percent return on the $2097 reach year and then invest the $1048 in profit into a Roth IRA again year over year and at the end of 40 years you would have over $600,000 and would have put in $41,920. Little things can build into something worthwhile if the long term is remembered. This about of money would be almost two times what the average person has saved at 60, and all it would have taken them was under $50, time, and patience over their life.

If the initial amount were grown for 14 years at 50 percent a year you would have over $10000 at the end of year 14. Getting 50 percent return on the $10000 every year of $5000, and then investing the $5000 in a Roth IRA for 36 years would give you almost $2 Million dollars. This is a sum of money which would let most people have a comfortable retirement and a good safety net in life. Remember the long term since a small amount can build financial engines which will pay off down the road. These examples don’t take into account the tax expense of earning the income from flipping. You could set a higher bar to earn $5000 after taxes and accomplish this goal.

I challenge anyone reading this to sit down with a calculator and do some simple compounding math to see what is possible if you focus on the long term with a situation like this. You would end up providing yourself with a nice return over a long period and also provide many items to people at a great value too. To me this a win for everyone involved in all the transactions you would be part of over many, many years. If you could focus on just making a solid buy each time you bought something then reinvest the profit and amount you had in the item from before you really can lead yourself into a much better financial situation. If you did this for ten years you would be amazed how much money you had at the end. If you did this for twenty years you would be more amazed, and if you could do this for the majority of your lifetime you could put yourself into a position which would have you in a place where you very well could be financially secure. Respect the long term and it will respect you.